|

Welcome to my homepage !

The "Projects" page has information about our book Artists and Markets in Music (Routledge 2024) including the new paperback version as well as other writings on political economy. Some of my research is also available on SSRN, RePEc and Google Scholar.

"Personal Info" has information on the Reggae Sunsplash Preservation Society where we have created a film archive and are restoring, digitizing and streaming more than 200 hours of concert film. Here also contains info about my other pursuits including our monthly current events program from a classical liberal perspective Hardfire TV.

"Teaching" contains syllabi for the courses I taught for more than 10 years until the covid era. Here you can also find the self-study principles of economics course I created with a YouTube channel in order to make the lectures avalable to 180 students dispersed to various parts of the world during the lockdown period. The intro courses usually take two semesters (make-work for economics instructors) but I have created a combined one semester version which covers the necessary and is better because combines instead of separates micro and macro.

On the "eBooks" page you can download Economics for Everyone, 2nd Edition, which includes a section on the Austrian School Explanation for the Business-Cycle, and which can help explain today's on-going inflation as well as the housing boom-and-bust leading to the financial crisis of 2008.

Thank you,

Cameron

Brooklyn, NY USA

contact: cameron_weber@hotmail.com

"There is no worse tyranny than to force a man to pay for something he does not want merely because you think it would be good for him." - Robert Heinlein

"Free trade is, I suggest, one issue which allows classical liberals to define themselves." - James Buchanan

George Will's opinion column in the Washigton Post, "Elon Musk vows to cut $2 trillion in federal spendng, Good luck." This spending cut would require addressing social welfare, a third rail in US politics. Will also calls it a free 'public education' (as in a lesson in public choice theory) for the word's richest person. December 2024.

This is doge.gov, we find that instead of trillions in reform-based spending cuts the result is more "waste, fraud and abuse" in the tens of billions. February 2025.

The Independent Institute takes stock of 100 days of DOGE and finds that they have done well if the DOGE findings are incorporated into future US government budgets. May 2024.

The lesson learned is that Congress is again side-stepping its duties and only taking 10% of the recommended cuts to the budget though recessions have started. CNN, June 2025.

Government Accountability Office (GAO)'s report recommending changes to the US government budget process which include adressing the budget deficit with each appropriations act in order to save the nation the catastrophe of debt default. December 2024.

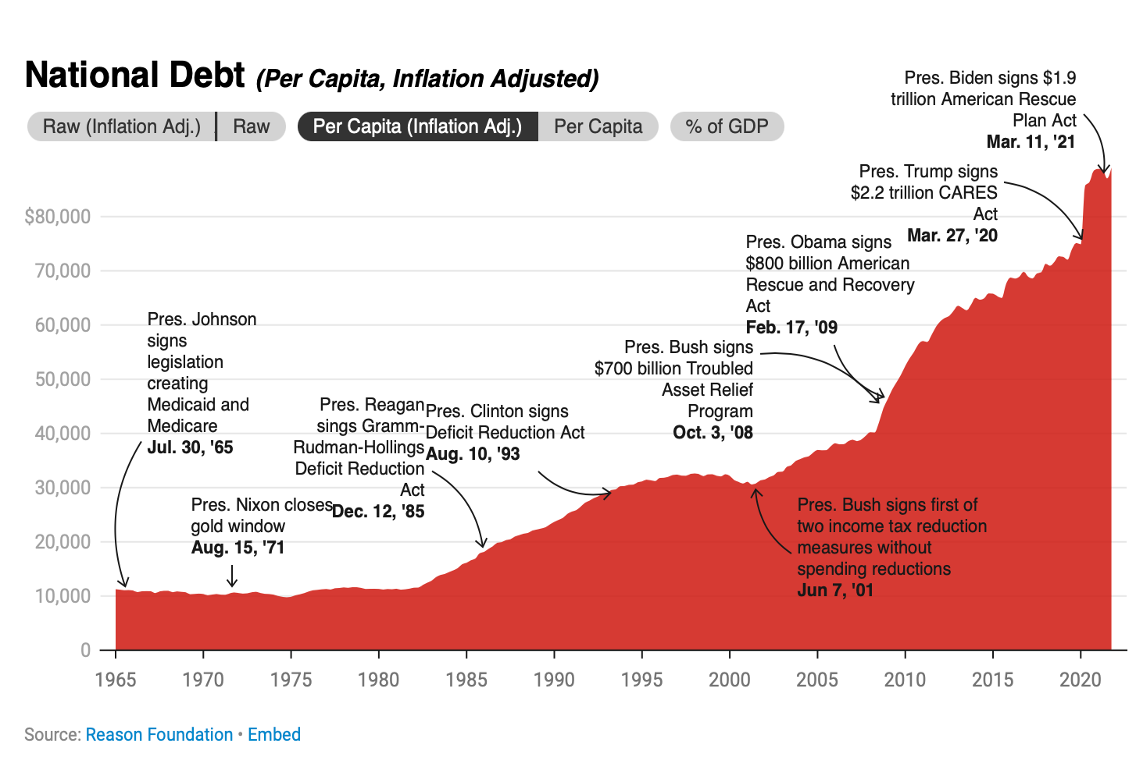

Reason foundation article, "The National Debt is $106 Trillion When Including Social Security and Medicare".This works out to more than $320,000 for each person living in the USA. March 2025

Economist Stephen Moore suggests in the New York Post ways the Department of Government Efficiency (DOGE) can save federal taxpayer money. December 2024.

In addition to these ideas I would add: 1) remove the tax write-off on debt interest payments from the tax-code, to reduce financialization of the economy and above normal profits to banks, 2) require that not-for-proift organizations such as universities and museums pay capital gains taxes on their endowments as is required of those in the private sector, and 3) that alt-currencies such as Bitcoin be exempt from capital gains taxes (as is the dollar) so that there might be competitive currencies to keep the central bank currency honest. This last idea is best articulated in F.A. Hayek's denationalization of money project. January 2025.

Realtime Inequality data visualization project from UC Berkeley.

Note that many common measures of inequality exclude state transfers received by the poor, non-salary benefits received by the middle class and taxes paid by the rich. The Economist has a piece on the debate in economics over inequality. December 2023.

This is the World Inequality Database site, they are tax-greedy, you can even use one of their algorithms to help determine how to get the most revenues, without of course evaluating the unintended consequences on the soending side. June 2025.

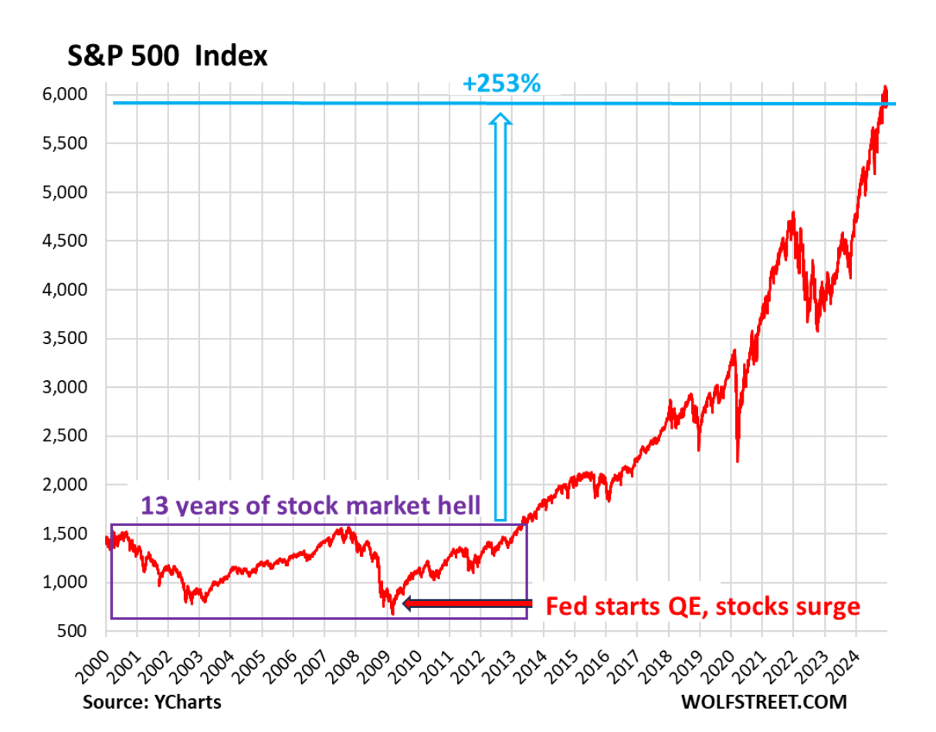

This is from Wolf Street which shows well that active monetary policy (QE) creates an increasing stock market. This of course leads to inequaity in that only the more wealthy you are the more you are able to invest in the stock market. While everyone else suffers price inflation.

Truflation is a source of reatime alternative data and shows that the inflation of the "bubble economy" inherited from the covid era has not receded consistently. We will see of course more inflation due to tariffs in the second Trump administration. December 2024.

The Economist finds that the nationalism and protectionsim in the US's trade policy including is creating a subsidy war with other nations, what we can call a "race to the bottom" or "beggar they neighbor" foreign policy. January 2023.

There was more than $6 trillion in 'emergency' spending during the covid era. Politically-based spending for votes today creates inter-generational inequity because it passes debt to those not voting and those yet born.

This has increased drastically in the last 15 years:

The risk rating for US government debt was downgraded in August 2023 due to the untenable debt situation. Wolf Street is good on this. And again in May 2025, to where US debt no longer has a good investment grade rating with any of the big three rating agencies. People are starting to proclaim the beginning of the end to the US dollar's dominance in the international economy due to the US government's unsustainable and growing deficit spending.

Now that the covid era is over it is time to do some stock-taking:

MIT and NBER find the Paycheck Protection Plan is distribution upward and that it costs around $200,000 "per job saved" while the average cost of employment in the private sector for wages and benefits is around $75,000. January 2022. The Federal Reserve Bank also finds that the PPP is regressive policy in that the more wealthy are recipients of these grants. July 2022.

NBER finds that federal covid "relief" transfers to states and municipalities cost more than $850,000 "per job saved". June 2022. Note that these transfers are also based on political party-affiliation patronage.

Arnold & Porter has created the CARES Act Fraud Tracker and has found that more than $150 billion has been stolen or fraudulent, updated often. March 2023.

OpenTheBooks.org finds that the NIH, specifically the National Institute of Allergies and Infectious Diseases, receives more than $700 million in royalties from pharmaceutical firms in 2022 and 2023. Many of these payments go to individuals within the NIH, and not just to the NIH itself. June 2024.

The Global Disinformation Index places those media outlets which criticize the NIH's pandemic reponse, and those reporting on politically sensitive events during the presidential election of 2020, on their "dynamic exclusion list". Exclusion lists are used to direct on-line media buys toward some media platforms and not others. The GDI brief recommending exclusion is issued one month before the election. The GDI is funded by the US State Department until April 2023.

"Myths of the 1 Percent: What Puts Some People at the Top", J. Rothwell, NYT, November 2017. Those working in sectors protected from competition by government policy continuously receive super-profits and capture wealth faster than everyone else.

"If People Were Paid by Ability, Inequality Would Drop", Rothwell has another article related to the above, this one on how professional associations have historically excluded minority groups from membership, November 2019.

Edmund Phelps, New York Review of Books, "What is Wrong with the West's Economies?", August 2015. Utilitarian and Rawlsian philosophies as manifested in policy in the modern welfare state has reduced entrepreneurship, human creativity and self-determination.

"Monopoly Isn't Always What We Think It Is", J.R. Rogers, Law & Liberty, November 2018. If there are no barriers to entry, there is no monopoly. And who best to limit competition but the state with its monopoloy on legal coercion.

This is the Government Accountability Office (GAO) Report of 2024 which determines the nation's fiscal health is unsustainable without substantive changes to welfare state entitlement programs.

Law and Liberty August 2022 article on what the Federal Reserve can do right and wrong, and needed reforms to reach that end.

This is T. L. Knapp's Freedom News Daily on google groups, a good news compiler.

This is something very funny, a Princeton professor lists on his CV all of his failures.

Nancy Pelosi's stock portfolio returned 65% in 2023, while the S&P gained 24% according to Unusual Whales, while Quiver Quantitative tracks her potfolio live. January 2025.

Further to political capitalism, Tesla stock went up 2.5% when Musk apologized for his social media posts about the US president. June 2025.

For fans of economics, here is a photo of the Economics Faculty building in Belgrade, Serbia (the center of economics for the former Yugoslavia).

From BYO Records, UK and from Nancy Folbre's website.

Here's Hayek's 1944 Road to Serfdom in cartoons, courtesy of the Foundation for Economic Education (FEE).

Paul Kelpe, Machinery (Abstract #2), 1933-34.

Here is the Living New Deal website, they have mapped more than 16,000 New Deal sites, including artwork. Although I think their economic program is faulty I support their historical work.

|

![]()

![]()